The Top Ten Cryptocurrency Blunders: A Must-Read Guide for All Investors

Are you eager to maximize your returns in the cryptocurrency market? If so, it's crucial to avoid common pitfalls that could lead to significant financial losses. This comprehensive guide will delve into the ten most critical errors crypto investors often make, which can result in substantial monetary losses. By understanding and avoiding these mistakes, you can ensure that your investments not only avoid unexpected setbacks but also thrive, leading to significant profits that can potentially change your financial future.

#1. Not Doing Your Own Research (DYOR)

One of the most common blunders for investors is the lack of thorough research before diving into an investment opportunity. It's easy to get excited, especially when a friend boasts about a lucrative altcoin investment that promises astronomical returns. However, it's essential to avoid getting caught up in the frenzy and instead take a step back to educate yourself.

This includes learning about reputable exchanges, secure cryptocurrency storage, and tax implications, as well as delving deeper into the specifics of individual crypto projects. By conducting your own research, you are taking control of your investments and empowering yourself with knowledge.

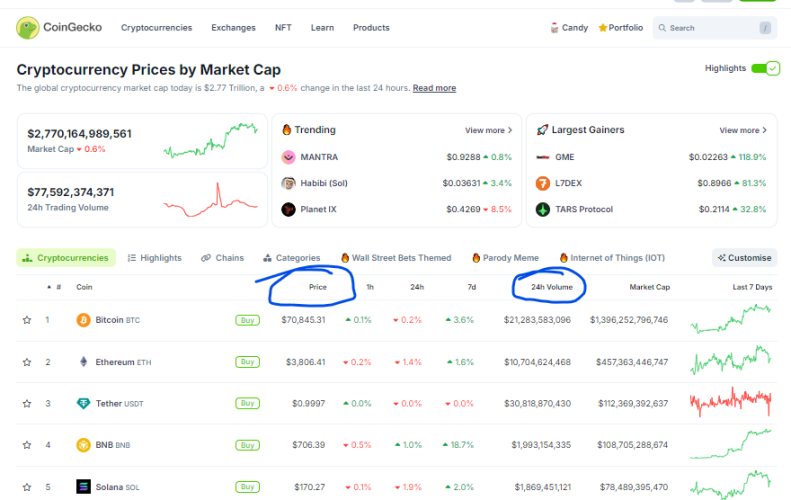

When evaluating research and projects, two crucial factors come into play. Firstly, verifying the project's authenticity and examining the token distribution is essential. To accomplish this, CoinmarketCap or CoinGecko can be used to analyze the coin or token. Delve into the data, focusing specifically on the price movement and trading activity. The trading volume should be substantial, indicating genuine interest and market participation. Additionally, the token should be listed on at least one reputable exchange.

Source: CoinGecko

With the basics covered, it's time to delve into more in-depth information from secondary sources. Explore cryptocurrencies on websites such as Messari, Binance Research, and CoinBureau, which provide comprehensive introductions to projects, their core teams, and objectives. Be sure to examine the profile section on Messari, which offers valuable insights into a project's background, token distribution, and other essential details.

It is essential to consider how tokens are allocated. It is favorable when tokens are distributed broadly among the community, indicating a healthy sign. Conversely, it raises concerns if a small group, often the founders, possesses most of the tokens. Additionally, it's essential to investigate the backgrounds and credentials of the founder, CEO, and other key team members. Videos featuring these individuals can provide valuable insight into their expertise and vision.

.png)

Source: Markethive.com

Previous interviews offer valuable insights into their progress in realizing their goals. Also, if they conduct regular meetings or webinars open to the public, it indicates transparency. Another key indicator of their credibility is their ability to follow through on their road map. At this stage, you should have gathered sufficient information to assess the project's authenticity and potential for long-term success.

#2. Opting For Inadequate Crypto Exchanges

Choosing the right exchange is a make-or-break decision. Many beginners and experienced cryptocurrency users fall into the trap of selecting the wrong exchange platform. The severity of this mistake can vary greatly, but it's crucial to start by verifying the exchange's authenticity. Unfortunately, many individuals are deceived by fraudulent crypto exchanges, underlining the need for vigilance in this crucial step.

Exercise caution when encountering sponsored advertisements for cryptocurrency exchanges, even when they appear on trusted news websites. Conduct thorough due diligence. Look into online discussions on Reddit, X, Bitcointalk, and other forums to see what users say about their experiences with these exchanges.

Additionally, investigate the exchange's leadership, including the founders' backgrounds and the company's history. Just as you would carefully vet individual cryptocurrency projects, it's crucial to apply the same level of scrutiny when evaluating exchanges, particularly those that are less well-known.

Next, ensure the exchange aligns with your investment approach. This involves checking if the exchange provides the specific tokens you want to purchase. Most exchanges will meet your needs if you focus on investing in well-established large-cap tokens. However, if you're interested in smaller-cap tokens with greater risk but the potential for high returns, you'll need to be more discerning in choosing exchanges.

While specific cryptocurrency exchanges boast an extensive catalog of digital assets, others, like Coinbase, have a more limited selection, comprising only a few hundred options. Nevertheless, Coinbase's strict adherence to regulatory standards as a publicly traded company in the US ensures the implementation of rigorous security protocols. This sets it apart from many other exchanges, which lack similar oversight and may not inspire the same confidence level.

Beyond security and coin allocation, consider whether the exchange's features align with your trading style. As a beginner, you may prefer an exchange with a user-friendly interface. If you're more seasoned, verify that the exchange offers the advanced trading features you need. Many exchanges cater to diverse skill levels by providing basic and advanced platforms, but exploring your options is essential to finding the best fit.

Finally, ensure the platform you consider using accepts your currency and does not charge excessive trading fees. High fees can ruin a successful trading day, especially when more affordable options are available.

#3. Impulsive Decisionmaking With No Strategy

The third mistake to avoid is entering the crypto market without a strategic approach. As the saying goes, 'Failing to plan is planning to fail.' This adage holds particularly true in crypto, where impulsive decisions often lead to regret. By establishing a well-thought-out strategy, you can confidently navigate the market, making informed investment choices rather than relying on chance. With a solid strategy in place, you can feel secure in your decisions and confident in your ability to navigate the market.

A solid strategy serves as a guiding framework, protecting you from making rash, emotional decisions and keeping you on track despite the influences of fear, uncertainty, and doubt (FUD) and the fear of missing out (FOMO). With a robust strategy and the discipline to stick to it, you can progress steadily without getting derailed.

Crafting a winning approach requires a tailored plan that suits your unique needs. Some general principles can serve as a guide. Start by setting clear and measurable goals rather than vague aspirations. Consider your comfort level with risk when setting these goals. For instance, someone in their early years without family responsibilities may be more inclined to invest heavily in cryptocurrency, whereas someone older with dependents may take a more cautious approach.

Regarding your cryptocurrency investments, you need to determine your comfort level with risk. Will you diversify your portfolio with smaller, more volatile altcoins, offering more significant growth opportunities but with higher uncertainty, or play it safer with established large-cap coins that provide more stability but limited upside? Additionally, should you hold onto your investments for the long term (HODL) or engage in active trading? This decision ultimately hinges on your personal risk tolerance and the trade-offs you're willing to make between security and potential returns.

Regardless of your investment approach, remember this crucial rule: never put in more money than you can comfortably part with, and refrain from taking on debt to fund your investments—it's simply not a risk worth taking. New investors, in particular, should resist the urge to amplify their bets with excessive borrowing, such as crypto leverage trading. Additionally, be sure to cash in on your gains periodically. Failing to do so is a common pitfall, so make it a deliberate part of your strategy, and you'll be grateful for it in the long run.

#4. Relying on a Centralized Exchange Instead of a Personal Wallet

Fourth on the list is a crucial security oversight: neglecting to self-custody one's crypto. To clarify, self-custody means having complete autonomy over your cryptocurrency by storing it in a personal wallet that only you can access and control. This approach is akin to keeping your physical cash in a personal safe rather than relying on a bank. For optimal security, self-custodial wallets are the recommended choice. Newcomers to the crypto world may wonder why they shouldn't simply store their funds on a centralized platform like Coinbase, Kraken, or KuCoin, but there are important reasons to avoid this approach.

Keeping some of your assets on these platforms for easy trading might be practical. However, there are risks when entrusting your assets to third parties online. Trusting the entity you are dealing with is essential, as some dishonest individuals are in the industry. A recent example is Sam Bankman Fried, who was once highly regarded in the crypto world but ended up causing significant financial losses to many. As a result, it's imperative to exercise extreme caution when dealing with online asset storage.

A second drawback of centralized exchanges is that, regardless of their trustworthy nature and rigorous security measures, they can never provide a guarantee against cyber-attacks. The cryptocurrency industry has witnessed a staggering $2.85 billion in losses due to theft from various exchanges and custodial services since 2012, demonstrating that no platform is entirely immune to breaches. Not even significant exchanges like Binance are immune, as evidenced by a hack they experienced in 2019 despite their robust security measures.

Cryptocurrency exchanges are attractive targets for cybercriminals due to the potential for substantial financial gains if their security measures are compromised. Malicious individuals seeking to take advantage of vulnerabilities in these platforms constantly threaten them. Additionally, regulatory uncertainties pose a risk for exchanges, as they may be subject to sudden closure or asset seizure by government authorities. An example occurred in 2021 when South Korea closed down 11 exchanges allegedly engaged in fraudulent activities.

Finally, there is a perpetual threat of financial collapse and insolvency. In such a scenario, users' assets could be at risk. The likelihood of this increases if an exchange fails to perform regular proof of reserve audits. Therefore, it is not advisable to keep assets on exchanges. Due to these concerns, the risks associated with storing assets on exchanges outweigh any potential benefits. As Benjamin Cowen, CEO of Intothecryptoverse.com, aptly puts it, "Treat exchanges like public toilets. Get in, do your business, and get out.”

So what should you do instead? You need to self custody your crypto by holding a non-custodial or self-custodial wallet. Non-custodial wallets are a broader category encompassing various wallets where users control their private keys. A non-custodial wallet can be browser-based or software-based, like Trust, Solflare, or Exodus, where users control their private keys. Although the wallet provider still bears some responsibility for safeguarding your assets, you have ultimate authority over your cryptocurrency.

Self-custodial wallets are a type of non-custodial wallet in which the user has complete control over their private keys and is responsible for managing their funds. They are hardware wallets like Ledger or Trezor in which the user has complete control over their private keys and is solely responsible for securing their assets. In both cases, the user controls their private keys and manages their funds. Still, the level of control and responsibility can vary depending on the type of wallet.

#5. Neglecting To Back Up Seed Phrases and Passwords

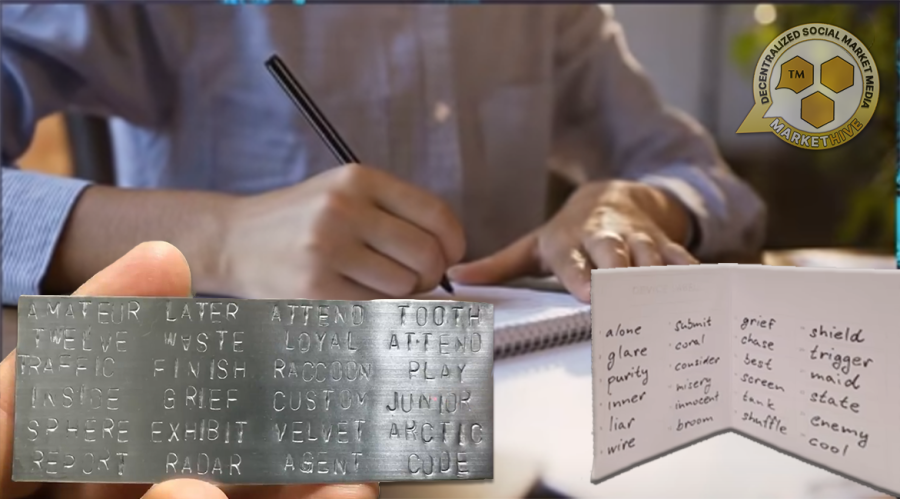

Another common security mistake is neglecting to create backups of seed phrases and passwords. A seed phrase is a set of words your cryptocurrency wallet generates and serves as the master key for managing and retrieving your funds. In the event of device failure, loss, or theft, your seed phrase is the only way to regain access to your assets stored in the wallet.

Storing physical copies of your seed phrases and passwords may seem inconvenient to some people. However, considering the importance of safeguarding your finances, it is essential to prioritize security over convenience. It is crucial that these backups are kept in a tangible format. Avoid saving seed words digitally on your device at all costs, as this dramatically increases the risk of your cryptocurrency being stolen by malware or cyber criminals.

Consider choosing between a paper backup method or engraving the information on a steel card for added security. Ensure that you store this vital information in a secure location. Additionally, take into account the security measures for your cryptocurrency exchange accounts. Implement two-factor authentication, and remember to store the backup codes needed for account recovery securely. Losing access to your phone can lead to being locked out of your account, resulting in a cumbersome verification process to regain entry. Prevent this potential hassle by documenting and safeguarding the codes along with your seed phrases in a secure container or safe.

#6. No Risk Management Plan

Effective risk management is essential for achieving long-term success in the crypto market. It is commonplace to become impulsive and deviate from your initial investment strategy. Staying composed during a bullish market is crucial to avoid making hasty decisions. Therefore, having a risk management plan tailored to your investment approach is vital.

A crucial rule of thumb for all investors is investing only money you are comfortable potentially losing. If you're an active trader, consider implementing risk management strategies such as stop-loss orders and profit-taking limits. These tools enable you to lock in gains when the market is favorable and limit potential losses when it turns sour. By doing so, you can avoid the need for constant market surveillance, providing peace of mind and a more hands-off approach to investing.

When managing risk, adopting a cautious mindset that extends beyond trading to include withdrawing your assets, also known as off-ramping, is essential. Many fall prey to a common mistake: sending funds to the wrong blockchain via an exchange. This mistake is easily preventable, but it can have irreversible consequences, and even with the help of wallet providers or exchanges, rectifying the situation is not always possible and can be highly stressful. To avoid this, take the precautionary step of sending a small test transaction to confirm the successful funds transfer. While this will incur some gas fees, it's a minor cost compared to the potential risks involved.

#7. Falling For Scams

Be cautious of fraudulent schemes, which are a significant concern in cryptocurrency and are closely related to managing risks. Conducting thorough research and remaining vigilant are essential to avoid falling prey to such schemes. Adopt a skeptical mindset and stay alert to potential red flags. Empowering yourself with knowledge of common fraudulent tactics is key to protecting your investments.

Some typical fraudulent schemes include Ponzi schemes, which rely on flimsy foundations and promise high returns but fail when new investments dwindle. Scammers may also attempt to attract victims to questionable investment platforms where funds are deposited but never returned. Another tactic is phishing attacks, where fraudsters create fake websites or emails to deceive individuals into revealing confidential information like private keys or wallet passwords.

Another insidious practice is pig butchering, a deceitful scheme in which individuals build a fake online connection with their targets and then manipulate them into divulging sensitive financial details or transferring funds. This deceptive tactic, akin to the tactics of the "Tinder Swindler," is prevalent in financial fraud. Moreover, cryptocurrency scams frequently exploit the influence of celebrities, using their images and names to deceive unsuspecting followers. Falling prey to such scams can have devastating consequences, not only draining your finances but also taking a heavy emotional toll on your well-being.

#8. Falling For FOMO

The following three mistakes are rooted in emotional biases. Although intuition has its place in some regions of life, it's essential to separate emotions from rational thinking when making investment decisions. The fear of missing out (FOMO) is a common psychological trap, and it can cleverly manipulate investors into making impulsive choices.

Theodore Roosevelt once pointed out the negative impact of comparing oneself to others on happiness, quoting, “Comparison is the thief of joy.” “This concept can also be applied to investing. During times of positive market trends and when your peers are succeeding, it can be tempting to abandon one's investment strategy and lose focus.

The proliferation of social media has exacerbated the problem, as overnight successes and compelling forecasts of price surges create unrealistic expectations. For instance, many individuals were convinced that Bitcoin would soar to $100,000 during the previous market upswing despite falling short. The allure of this narrative led people to hold onto their investments for too long, neglecting to cash in when they should have.

This reinforces the importance of developing a strategy tailored to one's risk tolerance and grounded in thorough research rather than following the crowd. Tuning out the noise and focusing on your approach is essential, a lesson closely tied to the following common pitfall: having inflated expectations, particularly among those new to the market.

#9. Inflated Economics

High hopes can sometimes result in significant letdowns. Viewing cryptocurrency investments as a means to rapid wealth can result in severe financial setbacks when reality fails to match these lofty expectations, particularly in the short term; investors often make ill-advised choices. Such mistakes include impulsively selling during market downturns or investing in high-stakes assets without adequately evaluating the risks.

It is crucial to have a solid strategy and adhere to it in order to succeed. By remaining patient and disciplined, your chances of success are higher. Should you experience good fortune in cryptocurrency, you must exercise humility and discretion. Boasting about your wealth can attract unwanted attention, and there have been disturbing instances where individuals who publicly flaunted their crypto gains online became targets of criminal activity. It's wise to keep your accomplishments private and avoid drawing unnecessary attention to yourself.

#10. Quitting Prematurely

Lastly, a common pitfall is surrendering too soon, which can cause investors to forfeit potential profits. The market's tendency to experience significant fluctuations can be intimidating, and those not prepared for such instability might quickly sell their assets during downturns, putting themselves at risk of losses. Exiting too early could result in missing opportunities for potential gains.

Successful investors are resilient and endure challenges, adapting their strategies and gaining knowledge along the way. Having a long-term perspective is key. While prices may experience significant fluctuations in the short run, it is essential to maintain a broader view. Viewing a bear market from a longer-term standpoint can offer a more positive outlook.

Patience and holding onto investments can eventually lead to significant gains. Sometimes, you just have to “hold on for dear life” and wait for your fortunes to moon. Finding a balance and following the profit-taking strategy mentioned earlier is prudent. It is crucial not to let short-term market trends distract you from your crypto journey and to keep the perspective of how far the cryptocurrency industry has come since its inception.

This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Also published @ Substack.com, BeforeIt’sNews.com, and Steemit.com

Bruce Jacobs

.png)