Effective Ways to Avoid Emotion-Based Investing

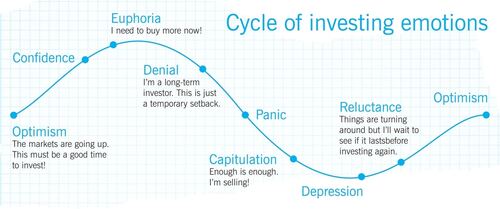

Effective portfolio monitoring is essential for navigating the changing tides of financial markets. Still, it is also necessary for individual investors to manage their behavioral impulses of emotional buying and selling of assets that can come from following the market's ups and downs. It is no secret that emotions play a significant role in investment decisions. This is because humans tend to make decisions based on feelings rather than reason.

Emotion-based investing is a term that refers to selecting stocks or other investments based on factors such as feelings, emotions, and intuition rather than purely objective analysis. The main reason why emotion-based investing can be dangerous is that it leads investors to make decisions without understanding the consequences of their actions. Emotion-based investors are more likely to react emotionally instead of rationally when making investment choices.

If you want to avoid emotion-based investing, it's essential to learn how to control your emotions and to measure how emotionally invested you are in investment. This is easier said than done, but you can use a few techniques to manage the situation, which will be discussed in this article.

Investor Behavior

Investor behavior is an essential topic of research that has been studied and analyzed for many years. Investor behavior can be broadly categorized into two types:

- Behavioral finance

- Financial engineering

Behavioral finance focuses on the psychological factors that influence investment decisions, while financial engineering seeks to use mathematical models and computer simulations to understand how markets work. Behavioral finance considers investor decision-making under uncertainty, which is a critical factor in modern portfolio management. Financial engineers use mathematics to model complex relationships between returns, risk, dividends payouts, stock prices, interest rates, etc.

Recognizing different investor behavior types can help you make more informed investment decisions. Investor behavior is a critical part of successful investing. By understanding different types of investor behavior, you can make informed decisions that will lead to greater returns.

Humanizing Your Investment Decisions

When making investment decisions, we often take into account the potential return on our investment, as well as the potential loss. However, it is often difficult, if not impossible, to divorce ourselves from emotion when making these decisions ultimately. For example, we may feel excitement, fear, or panic when considering a potential investment loss or gain, and this can tilt the scales in favor of an investment that would otherwise be seen as risky.

Image Source Cooperators

Image Source Cooperators

We often humanize our investment decisions by attaching emotions, thoughts, and feelings to the different choices we make. We might justify a decision based on how it makes us feel or what it means to us. This tendency can significantly impact our financial decisions because it can lead us to overlook important facts and risks. Our emotional attachments can also distort our judgment about risk-reward relationships, which could result in poor investments.

Time-Tested Theory

The belief that several market participants buy at the top and sell at the bottom has been proven by historical money flow analysis. The analysis looks at the net flow of funds for mutual funds and constantly shows that when markets are hitting highs or lows, buying or selling is at its highest. The notion of a trade cycle has also become accepted as most economic cycles have a 3 to 6-year period where money flows into equities and then flows out for the next ten years or more.

This theory was first introduced by Benjamin Guggenheim and later popularized by Paul Samuelson, who called it "the efficient market hypothesis" (EMH). Much research has been done on this subject, including work by Eugene Fama, Robert Shiller, Mark Rubinstein, and John Campbell.

While this concept was well known to Wall Street in the 1980s, it's now being applied to individual and institutional investors as we all try to time our investments to make a profit based on price movement rather than fundamentals and timing market tops and bottoms. A Simple strategy that worked over 30 years ago, legendary investor Bruce Kovner described an investment strategy he called "buy and hold."

Image Source Sarwa

Image Source Sarwa

It seem like a challenging approach, but it works! His method involves purchasing stocks at low prices and holding them until they rebound. This is a great way to find bargains because the stock market will go up over the long term more than down.

Understand the Benefits of Market Timing

Market timing is an investment technique that predicts the stock market's direction. Market timing has been shown to be a very risky strategy. The main reason why market timing is so dangerous is that it can lead investors to buy high and sell low, which often results in significant losses. There are many reasons why market timers fail: they may incorrectly predict future trends, focus on short-term rather than long-term factors, or make decisions based on emotions rather than sound logic.

There are many benefits to market timing, including:

- Increased returns

- Increased profits

- Better risk management

- More accurate portfolio allocation

- Easier investment

The best time to invest in stocks or other securities is when the market is undervalued. When the market is overvalued, there is a greater chance that a security will appreciate, regardless of the quality of the underlying business. When the market is correctly valued, you can profit by buying undervalued securities and holding them until they reach their actual value.

The key to good market timing is to use a diversified portfolio that includes a wide range of securities. By diversifying your investments, you reduce the risk of panicking and making poor investment choices. By investing in a variety of assets, you can ensure that you are exposed to a variety of markets and will have a chance to capture favorable market trends.

Techniques to Take the Emotion Out of Investing

Investing is a vital part of any person’s life. It can provide security and stability and help achieve financial goals. However, like any other activity or decision-making process, investing comes with its own emotions and concerns that need to be considered when making an investment choice. The emotional component of supporting stems from the fact that investing involves risk and potential gains and losses.

Two things are difficult to cope with emotionally, especially if you have just started on this journey of building wealth for yourself and your family through investing and savings decisions and actions over time. The first thing to understand about the “emotional” aspect of investing is that it has to do more with how we make decisions rather than what we decide to invest in or not since many factors are involved in such decisions.

The second part is understanding how to get rid of them to make informed decisions based on facts and figures, not feelings and biases which can lead to wrong choices or decisions that may come back to haunt you later on in your investment journey (and life).

There are several strategies that investors can use to take the emotion out of investing so that they can make informed decisions based on facts and figures alone. Let’s have a look at some ways to take the emotion out of investing and start investing more effectively and safely.

Be Patient

Image Source Sarwa

Image Source Sarwa

When it comes to investing, patience is key to success! I know that seems contradictory but bear with me for a moment. In my experience, when you think about what you can do to improve your financial situation, it is easy to get caught up in trying to solve all your problems today. Rather than focusing on solving them one step at a time over the long term and ensuring that those steps work for you every day of the week, even if they feel small and unimportant, to begin with. The first step towards increasing your financial literacy level is understanding where you currently stand financially and then deciding how you want your finances to be in the future.

Remember the Past

When the market takes a deep dive, remember that this isn't the first time it's happened. The stock market has overcome many obstacles, such as 9/11, the Great Recession, and the market crash of 1987. It is always destined to recover eventually, although a few people might argue that the market hasn't recovered yet, considering the recent decline in stock prices and unemployment rates, which need attention for countries to come back on track economically and socially.

So when a crisis hits like what we're experiencing now, investors need to remember that panic is the worst thing they can do. Inexperienced investors who have only seen a bull market are more prone to become emotionally charged during times of prolonged volatility.

Benjamin Graham, a British-born American economist, professor, and investor, once said,

"individuals who can not master their emotions are ill-suited from profiting from the investment process."

Consult With an Expert

Consulting with a financial expert will help you examine the accuracy of your thinking and give you something else you need; which is time. If you can not afford a financial advisor, at least speak to someone before you make an investment decision. That is, as long as they are knowledgeable enough and not panicking. (Of course, some people are both.)

You must choose the right company for you because many investment companies have investment offers that may be suitable for one type of investor but not another, or investors in certain countries but not others. When choosing an investment firm, you need to know which investment types to look out for. Be sure you're willing to accept the risk level if you want to invest your money with them, such as investing through the stock market, putting cash into bank accounts, bonds, certificates of deposit, crypro, or any other investments.

Control Your Risk Aversion

You can control your risk aversion by understanding why you feel the way you do. We all have a fear of losing, which is based on our past experiences. You are likely to have lost lots of money in the past. You remember this pain very well, and it has influenced your current investment behavior. When we are faced with a risk we do not understand, our brain automatically sends a signal to our body to reduce our intake of that risk. We do this by reducing the amount of dopamine which is a neurotransmitter.

To be able to make informed investment decisions, we need to be able to take the emotion out of it. We can do this by breaking the decision down into smaller steps. This is where the technique of breaking down a problem into manageable steps can be of great help. By doing this, we can reduce the fear of Failure and increase our chances of success.

Other things to consider are:

- Be cautious when investing heavily in shares of any stock

- Evaluate your comfort zone in taking on risk

- Draw a personal financial roadmap

- Evaluate an appropriate mix of investments

- Cultivate and maintain an emergency fund

- Consider rebalancing your portfolio occasionally

- Resist circumstances that can lead to fraud

Develop a System of Investment

There are several benefits to developing a system of investment. One advantage is that an investment system allows you to make prudent decisions concerning your overall financial status. You can adjust your asset allocation as needed to match your risk tolerance and desired return objectives. Furthermore, an investment system allows you to take advantage of compounding returns, resulting in high returns over time.

To create an investment system, you must clearly understand your goals and objectives. You also need to understand your financial situation and risk tolerance clearly. Once you have established these baseline parameters, you can start constructing a system of investment. Many options are available to you, and choosing the appropriate one for your unique circumstances is crucial.

The Bottom Line

Successfully Investing without emotion is easier said than done, but some key considerations can prevent individual investors from chasing wasted profits or panicking by overselling. Understanding your investment risk is an essential basis for making rational decisions. It is also important to actively understand the market and the forces driving uptrends and downtrends.

The following questions will help you build a solid foundation for investing without emotion:

- What are your expectations?

- How do you feel about your past experiences?

- Do you have any biases that might cloud your ability to make sound decisions?

- Can you clearly define what constitutes a “win”?

- Do you believe in luck or miracles?

- Does your family history affect how you think about money and finance?

- How much time do you want to spend learning?

- Are you willing to pay the price in time, effort, and attention required to develop and maintain a disciplined approach to investing?

If you provided unbiased answers to these questions, then it is possible to invest successfully without emotion. While sometimes aggressive and emotional investing can be successful, overall, data shows that following a realistic investment strategy and staying the course despite market volatility often yields the best long-term performance returns.

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advise.

Bruce Jacobs

.gif)